Introduction

As one of the leading telecommunications groups in Asia with a presence in 11 countries and a customer base of approximately 350 million, Axiata Group Berhad (Axiata) makes a substantial contribution to the countries in which the Group operates. Through its investments in its portfolio of operating companies across the region, Axiata is recognised as one of the largest Foreign Direct Investors, best employer, significant taxpayer and substantial purchaser of local services.

Axiata’s business of providing telecommunications, network infrastructure and digital services have created significant economic value and opportunities, both directly and indirectly to close to two billion people across the ASEAN and South Asia region.

Additionally, as a committed long-term investor, Axiata has further supported and created non-economic value in areas identified as national priorities and agendas in the countries within its footprint.

To continue to make an economic difference in the countries and communities it serves, Axiata has been measuring its investment impact in its National Contribution Report annually over the past four years. In the 2017 report, a new multiplier (i.e. the Capex multiplier) was included to measure the economic return on Capex by taking into account the GDP contribution from Axiata’s operations and capital investments, as well as the productivity impact generated by the use of Axiata services through the increase in mobile penetration.

2017 National Contribution Report:

Key Report Findings

- Contributed USD15.9 billion to the national GDPs of countries where we have a a telecommunication presence

- Collective direct operational and capital expenditures reached USD7.6 billion and USD2.8 billion respectively

- Every USD1 spent by the Group translated to between USD4.6 and USD8.0 contribution to GDP in six key operating markets

- Across the region, both directly and indirectly, one million jobs are supported by Axiata companies

2017 National Contribution Report:

Report Scope and Information

This report consists of an economic impact assessment at six of Axiata’s major operating companies. The report includes a two-part analysis comprising:

-

Economic and financial analysis of the Axiata operating companies’ contribution to the national economy, which includes an assessment of the following:

- economic contribution to the nation

- investment and innovation for the long-term

- contribution to public finance

- talent development

- labour productivity

- Assessment on Axiata companies’ contribution and support to national priorities.

USD

15.9 billion

Contribution in 2017

GDP

Spent

USD

7.6 billion

on operating expenditure

Capital Investment

in 2017

USD

2.8 billion

Supported more than

1.0 million

jobs across the region for 2017

Served approximately

350 million

customers

Employed approximately

27,000 employees across ASEAN and South Asia

Multiplier effect for every

USD1

spent on

Capex

generated

Malaysia

Indonesia

Sri Lanka

Bangladesh

Cambodia

Nepal

USD5.7

USD8.0

USD5.3

USD5.6

USD4.6

USD7.2

GDP contribution

Malaysia

Celcom is Malaysia’s leading data network provider, with 9.5 million customers. Established in 1988, it boasts the nation’s widest 2G, 3G and 4G LTE networks, covering over 98% of the population. Currently the largest mobile broadband and corporate services provider, Celcom is moving towards integrated multi-access and multimedia services, in line with evolving technologies and consumer behaviour in Malaysia. A culture that places the customer FIRST™ is reflected in our award winning customer service, products, and other corporate accolades at a regional level.

In 2017, the Malaysia’s digital economy contributed 18.2% to the country’s GDP and is expected to exceed the projected target of 20% earlier than the 2020 target. As SMEs represent over 76% of Malaysian businesses, the government is focused on launching initiatives to empower local SMEs and micro business to unlock growth opportunities in the digital economy.

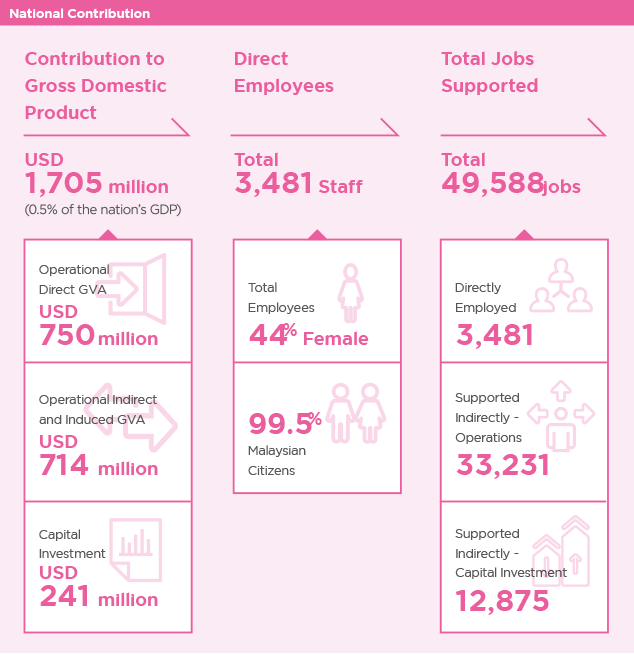

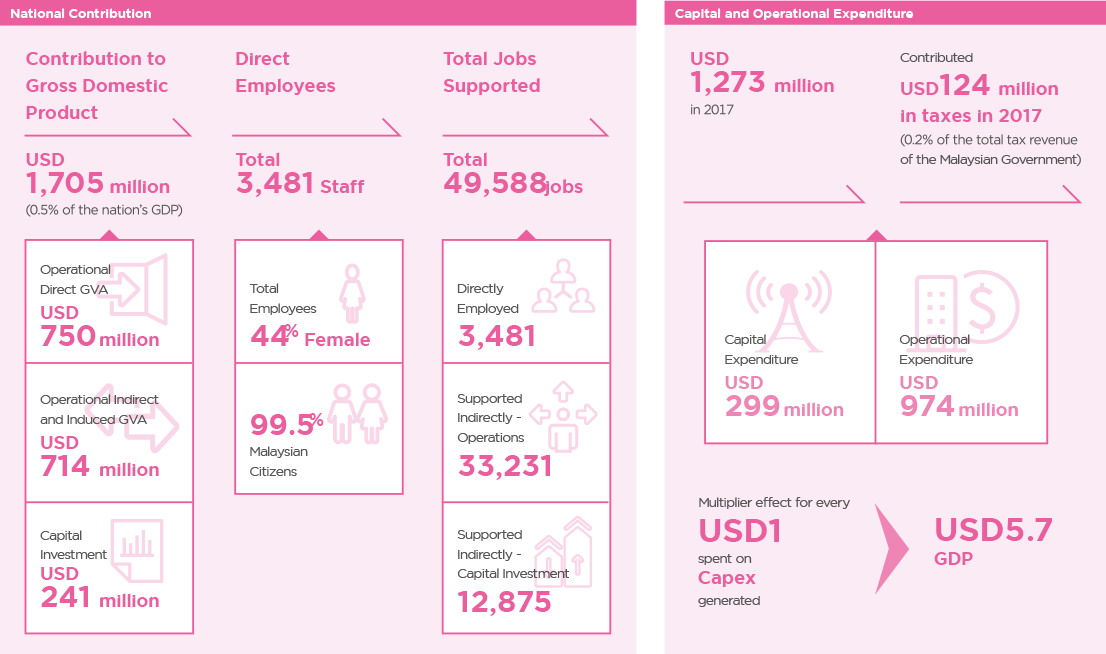

Figure 1: GDP contribution to the Malaysian economy 2017

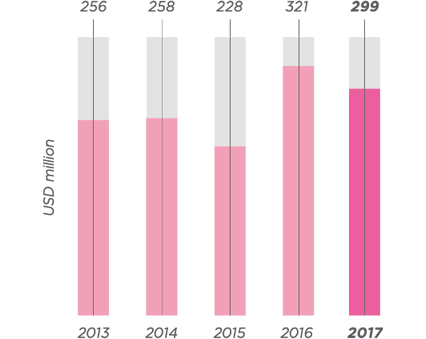

Economic and Financial Contributions

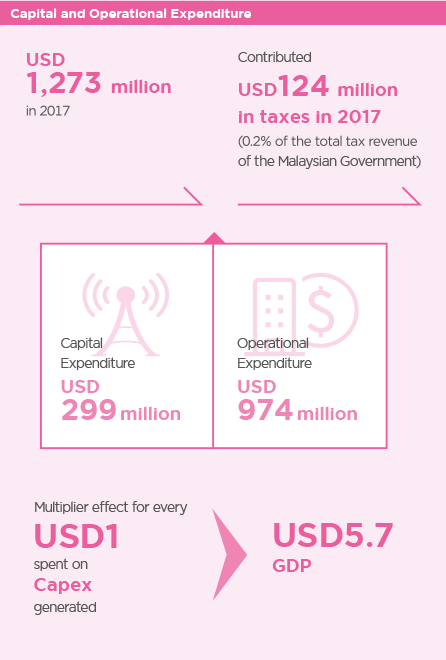

With a total operating expenditure of USD974 million and capital investment of USD299 million, Celcom’s total GDP contribution to the Malaysian economy was estimated at USD1,705 million. This comprised contributions from Celcom’s direct operation of USD750 million, indirect contribution of USD714 million through procurement from local suppliers, and USD241 million generated by Celcom’s capital investment (see Figure 1). Every USD1 spent by Celcom through its capital investment contributed USD5.7 to the GDP.

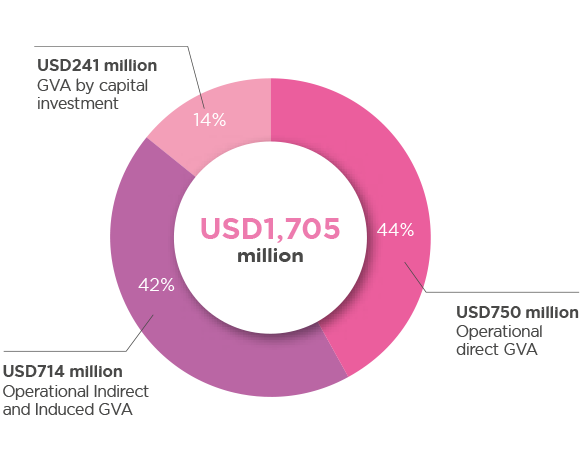

Investing and Innovating for the Long-Term

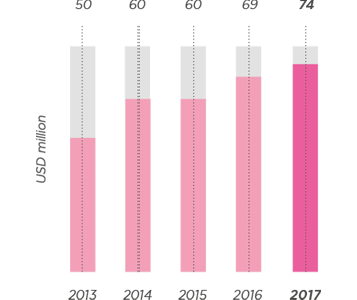

Celcom invested a total of USD1,363 million between 2013 and 2017 towards improving its products and services, expanding its network coverage, introducing new technology and enhancing its infrastructure for the Malaysian market. Total investment of USD299 million in 2017 represented a 7.1% decrease compared to USD321 million in 2016 (see Figure 2). Overall, however, the significant investments over five years demonstrates its commitment trend towards long-term development and continuing contribution to the Malaysian economy.

Figure 2: Total capital investment: 2013-2017

Contributions to Public Finance

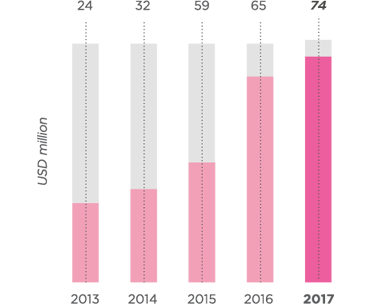

Total tax contributions for Celcom over the last five years totalled USD1,428 million. The drop in total annual tax contributions since 2014 is due to falling operating profits. In 2017, Celcom contributed USD124 million in taxes, accounting for 0.2% of the Malaysian Government’s total tax revenue (see Figure 3). Celcom’s tax commitments in Malaysia includes direct taxes such as corporate and withholding tax, as well as indirect taxes such as value-added tax and licensing fees.

Figure 3: Total tax contributions to public finance, 2013-2017

Note: Total tax revenue for the Federal Government. (Source: 2013-2017 budget, Ministry of Finance)

Talent Development

Celcom provided 3,481 direct jobs in 2017 of which 99.5% were staffed by Malaysian citizens (see Figure 4). About 44% of Celcom employees were women, which is higher than the national average of 32%. Celcom’s operations also indirectly supported an additional 33,231 jobs through its engagement with suppliers, and a further 12,875 jobs through Celcom’s capital investments. As Celcom undergoes a business and culture transformation towards being a modern, agile and digital company, significant efforts will be spent on reskilling and upskilling employees in UI/ UX, Analytics and Data Science.

Figure 4: Total employment impact 2017

Celcom’s Labour Productivity

Celcom’s productivity, measured as Gross Value Added (GVA) per employee, reached USD215,379 in 2017. This represents a decrease from USD344,008 in 2013, mainly due to a fall in Celcom’s direct GVA contribution.

Figure 5: Celcom’s labour productivity , 2013-2017

Supporting our Local Business Partners and SMEs

Axiata and Celcom are committed to advancing the national agenda of developing the capacities and capabilities of local Bumiputera SMEs. In 2017, Celcom spent RM951 million on local Bumiputera companies and maintained more than 50% spend on Bumiputera vendors.

Celcom’s Local Partner Development Programme supports 50 Bumiputera vendors, business, and strategic partners by providing capacity-building programmes and networking opportunities to scale competitiveness of their business. We provide additional support to our local partners by working with government agencies to provide technical advise such as from the Ministry of International Trade and Industry, as well as MARA, SME Bank, CEDAR, JCORP, MDEC, MIDF, PUNB and TERAJU. In 2017, 15 of our local partners enrolled in training and development programmes with these agencies.

Axiata Partner Development Programme aims to develop Bumiputera entrepreneurs beyond Malaysia’s shore. The programme targets to nurture four National, two Regional, and one Global Champion by 2020. In 2017, the programme developed its first regional champion, KAT Group of Companies, a pioneer in Malaysia’s mobile prepaid distribution business. KAT Group was awarded a contract to implement its proprietary KATSsys platform in Ncell, Nepal. KATSys will drive Ncell’s end-to-end sales and distribution management system.

In Support of the National Agenda

Malaysia’s National e-Commerce Strategic Roadmap aims for e-commerce to contribute 20.8% to the nation’s GDP by 2020. The advancement of digital services and investment in infrastructure will be key enablers to drive this national commitment to build a digital economy.

Infrastructure

Enhancing connectivity is critical to rolling out a digital economy. Malaysia aims to improve the coverage, quality and affordability of its digital infrastructure under the Eleventh Malaysia Plan 2016-2020, with a focus on infrastructure investment to support economic growth. The Malaysian Communications and Multimedia Commission aims to provide access to 95% of populated areas with broadband at higher speeds and lower prices by 2020. Over RM1 billion has been allocated towards this initiative.

Celcom’s investments and efforts to improve the digital infrastructure will strengthen the productivity and efficiency of the Malaysian economy. Together with Ericsson, Celcom performed South East Asia’s first 5G trial on the 28GHz band. Celcom also launched two high-speed fiber internet connection services in Sabah; the Celcom Home Fiber and Celcom Business Fiber. Both plans provide 10x faster unlimited internet download speeds of up to 100 Mbps, the most advanced broadband services for homes and businesses in the state.

E-commerce

E-commerce is an essential component within the digital economy. It is expected to accelerate cross- border business and boost the overall economy by contributing 18.2% of national GDP by 2020. Several initiatives have been established to drive this government agenda. The Malaysian Digital Economy Corporation has been allocated RM162 million to develop an e-commerce ecosystem. Other national programmes include the Mydigitalmaker movement and the Malaysia Digital Hub.

Celcom has invested in partnerships to build e-commerce portals to support the emerging e-commerce ecosystem. In 2017, in partnership with World of Gifts, Celcom developed a digital platform, ‘OleOle’. It allows customers to instantly send and receive e-voucher from a variety of brands. Once redeemed, the e-vouchers can be used to purchase items on exclusive partners’ online stores or mobile applications.

Indonesia

PT XL Tbk is one of Indonesia’s leading telecommunications service providers. XL offers an array of innovative products and services ranging from voice, SMS and Value Added Services (VAS) to mobile data covering more than 90% of the population throughout Indonesia. XL continues to innovate and transform itself into a leading mobile data provider, serving the burgeoning demand for mobile data amongst Indonesians.

Indonesia aspires to be the largest digital economy in the region, targeting USD130 billion online transactions by 2020. In 2017, Indonesia launched its “2020 Go Digital Vision” which has set targets for growing the digital economic contribution in agriculture, SMEs, connectivity and tech startups. Indonesia’s 57 million SMEs account for more than 60% of the country’s GDP. The government’s plan includes supporting eight million SMEs to be “digitally empowered” by 2020 to continue this growth path. The plan also targets to get one million local farmers and fishermen to sell and promote their produce online.

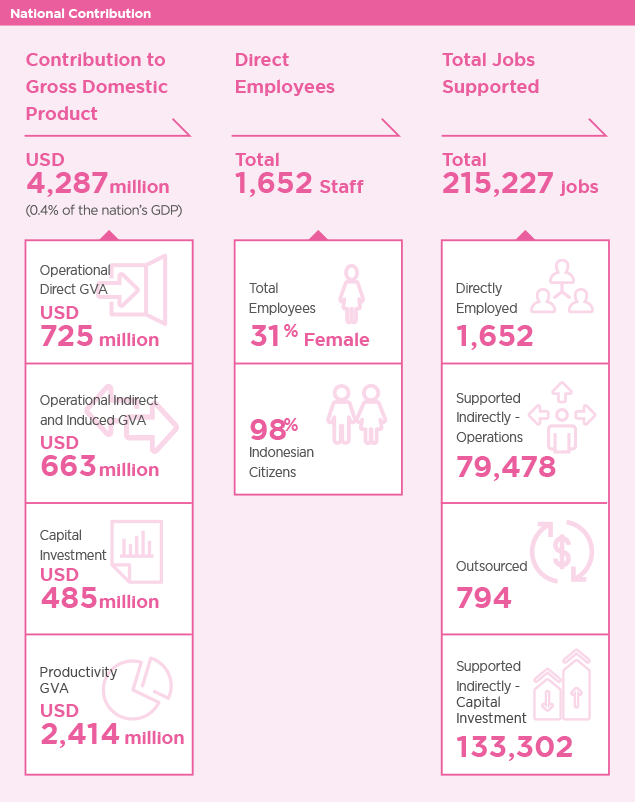

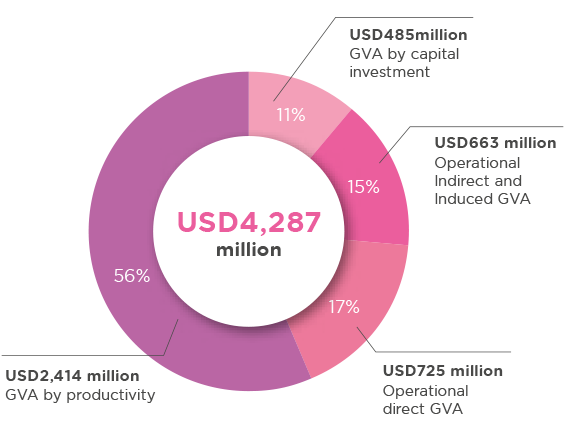

Figure 1: GDP contribution to the Indonesian economy 2017

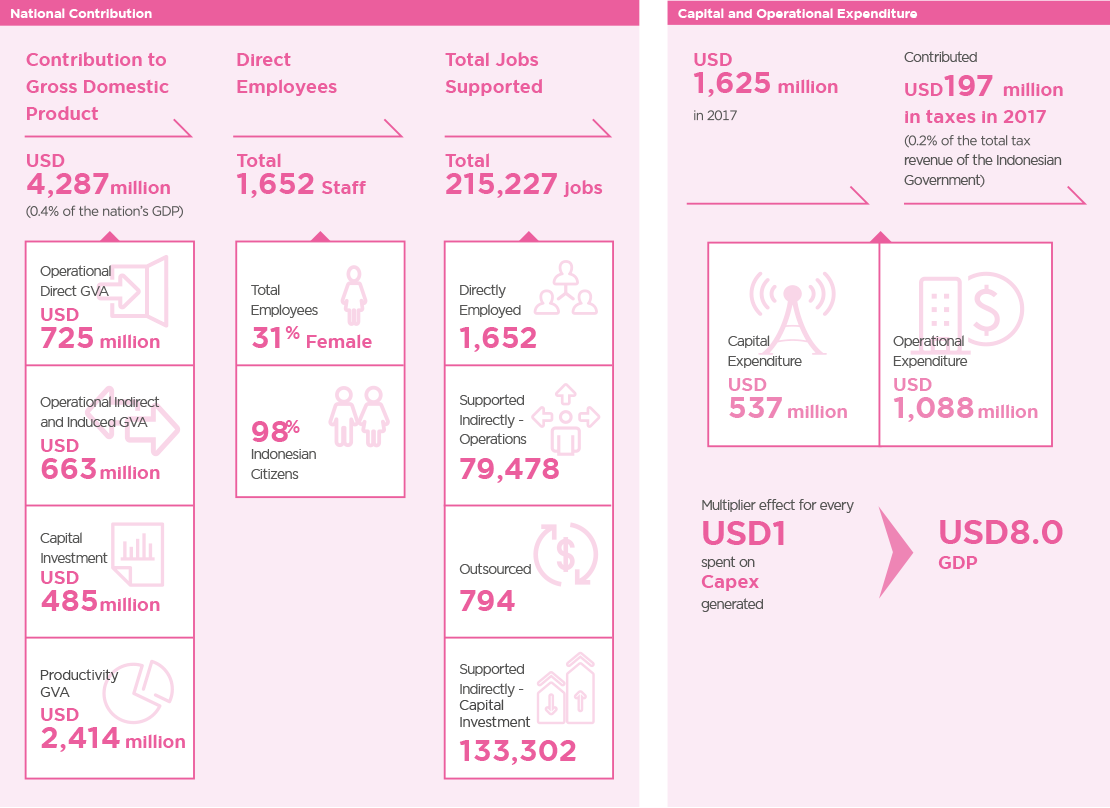

Economic and Financial Contributions

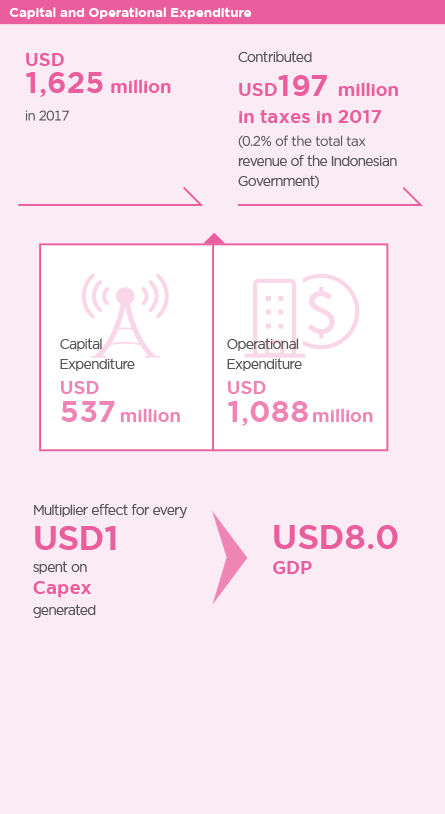

With a total operating expenditure of USD1,088 million and capital investment of USD537 million, XL’s total GDP contribution to the Indonesian economy was estimated at USD4,287 million. This comprised contribution from XL’s direct operation of USD725 million, indirect contribution of USD663 million through procurement from local suppliers, USD485 million generated by XL’s capital investment and productivity gains of USD2,414 million through the increase in mobile penetration rate of 16.2% in 2017 (see Figure 1). Every USD1 spent by XL through its capital investment contributed USD8.0 to the GDP.

Investing and Innovating for the Long-Term

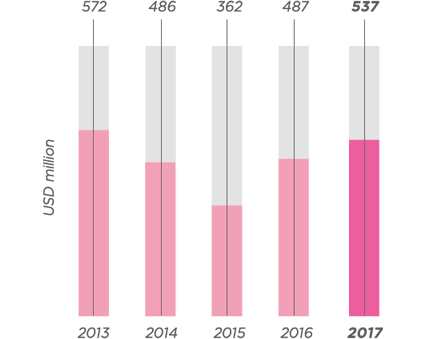

XL invested a total of USD2,444 million between 2013 and 2017 to improve its network and in launching new innovative products and services (see Figure 2). The OpCo’s total investment of USD537 million in 2017 represented a 10% increase from USD487 million in 2016. XL continues to innovate on its VAS and quality of services to grow its presence in the country.

Figure 2: Total capital investment: 2013-2017

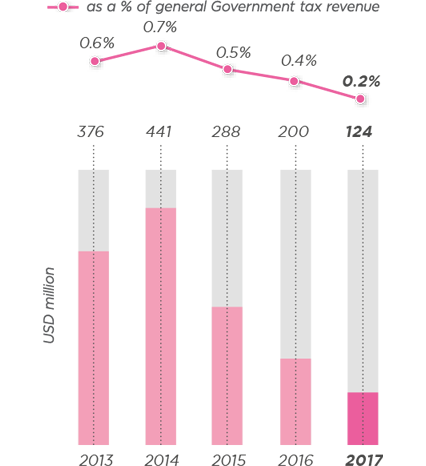

Contributions to Public Finance

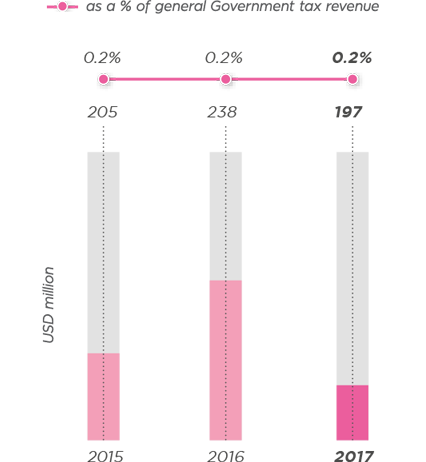

XL contributed USD197 million in taxes to the Indonesian Government in 2017, accounting for 0.2% of the country’s total tax revenue (see figure 3). XL’s tax commitment in Indonesia includes direct taxes such as corporate and withholding tax, as well as indirect taxes such as value-added tax and licensing fees.

Figure 3: Total tax contributions to public finance, 2013-2017

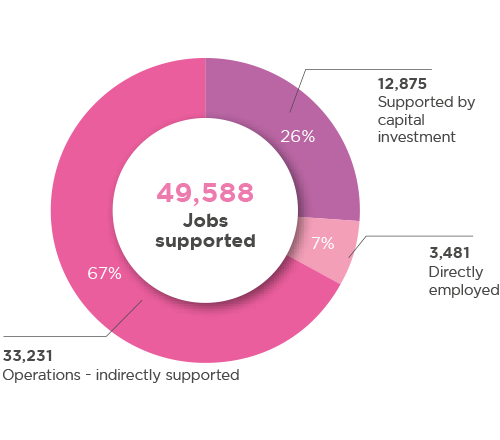

Talent Development

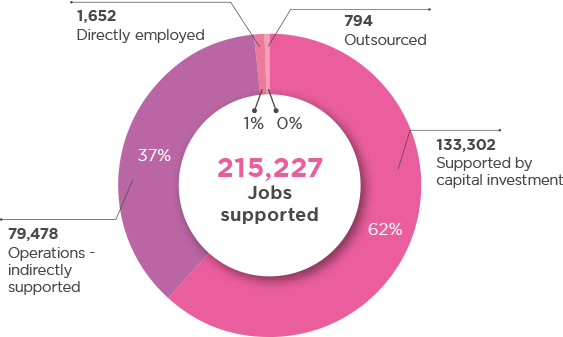

XL provided 1,652 direct jobs in 2017 of which 98% of positions were staffed by Indonesian citizens. About 31% of XL employees were women. During the year, XL engaged 69 new graduates, apprentices and interns as part of its goal to provide young people with specialist skills required in the digital economy. XL’s operations also indirectly supported an additional 79,478 jobs and outsourced a further 794 jobs. Its capital investments, meanwhile, supported 133,302 jobs (see Figure 4).

Figure 4: Total employment impact 2017

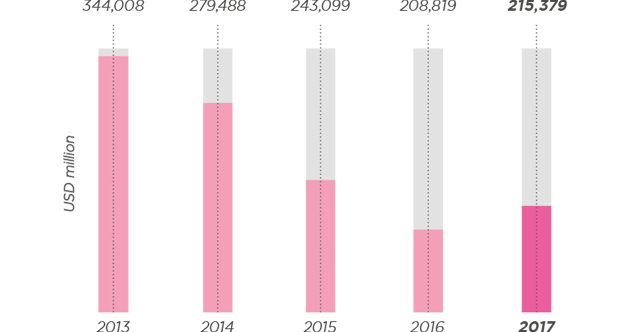

XL’s Labour Productivity

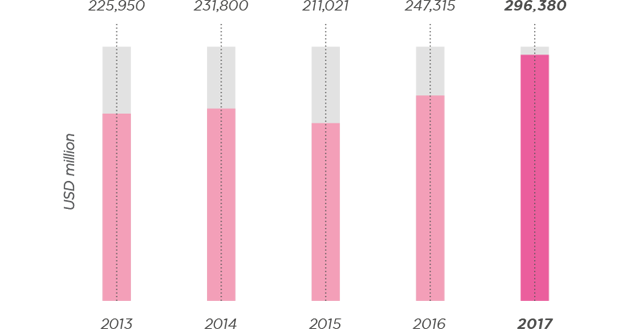

XL’s productivity, measured as Gross Value Added (GVA) per employee, reached USD296,380 in 2017. It grew by 19.8% from USD247,315 in 2016 (see figure 5). This is mainly due to an increase in operational profit and a reduction in number of employees.

Figure 5: XL’s labour productivity, 2013-2017

In Support of the National Agenda

With the region’s largest population, Indonesia is looking towards the use of smart solutions and education to ensure sustainable development of the country. Leveraging on the scalability of digital services, Indonesia is pushing the envelope to explore creative solutions to strengthen adoption and integration of ICT into the daily lives of its citizens.

Smart Solutions

Over 70% of Indonesia’s population is expected to live in cities by 2025. The development of smart city solutions will increasingly be important to improve urban mobility, increase operational efficiency, share information with the public, and improve both the quality of government services and citizen welfare.

Several Indonesian cities are already developing and adopting smart city solutions. Jakarta launched a Smart City programme and established a command center with co-working space for startups. In Denpasar, several mobile applications were developed to assist in the fishery sector and flood monitoring. In Surabaya, the local government implemented an e-government service to better connect and improve public services. Bandung established a command center integrating street lighting, and system to monitor traffic flow. Xmart City is XL’s digital platform to enable city administrations to connect and collect data from residents.

XL continues to expand 4G LTE services to underserved areas to support the government in closing the digital gap. XL’s network infrastructure under the Universal Service Obligation (USO) programme ensures that rural communities are not left behind. In cooperation with the Ministry of Marine Affairs and Fisheries (KKP) and the Ministry of Communication and Informatics, XL launched the programme “Fisherman Go Online” for fishermen across the region. The programme empowers fishermen to use digital technology to manage their operations, boost productivity, and improve fish catch.

Education

The improvement of education standards in Indonesia has been emphasised in the National Medium-term Development Plan 2015-2019. Indonesia launched the ‘Smart Indonesia’ programme to improve the country’s quality of education and training. The programme aims to improve enrolment, reduce drop-outs, promote gender equality in education, and prepare students for job market. The Ministry of Education and Culture highlighted the importance of ICT infrastructure to improve education and introduced “Smart School” programme for Indonesian schools.

XL introduced several initiatives to support and develop Indonesia’s education. It built and developed a free online learning platform incorporating the principles and programmes of XLFL Global Leaders, one of Indonesia’s most comprehensive and longest running youth leadership programme. This has allowed over 20,000 young adults across the country to learn leadership skills. XL also expanded internet coverage for students to further support education in Indonesia. Over 4,000 students in 100 schools in East Kalimantan are now connected to fast internet through XL’s initiative.

Sri Lanka

Dialog Axiata PLC operates Sri Lanka’s largest and fastest growing mobile telecommunications network. It is one of Sri Lanka’s largest listed companies by market capitalisation, and largest Foreign Direct Investor with investments totalling USD2.3 billion. Dialog, a winner of six GSMA Mobile World Awards has the distinction of being voted by Sri Lankan consumers as the Telecom Service Provider of the Year for the sixth successive year as well as the Internet Service Provider of the Year at the SLIMNielsen People’s Choice Awards for the fifth successive year. Dialog has topped Sri Lanka’s Corporate Accountability rankings for the past seven years in succession.

Sri Lanka is currently developing its digital economy strategy. This initiative will enable Sri Lanka to identify appropriate opportunities, key enablers, and initiate flagship programmes that will promote Sri Lanka’s Digital Economy strategy. The digital economy strategy will align with the economic development thrust sectors of agriculture, tourism and manufacturing. It is estimated that the digital economy for Sri Lanka could contribute 1%-3% to the nation’s GDP by 2019.

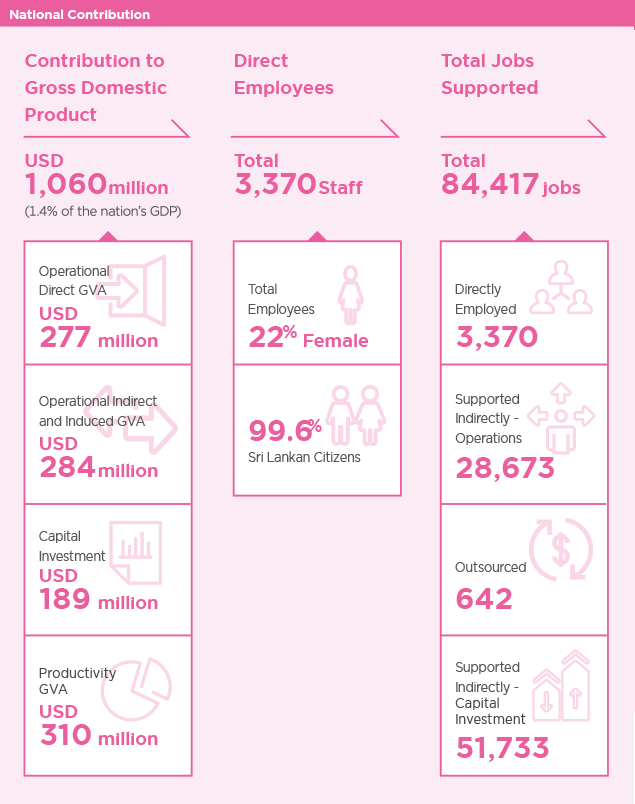

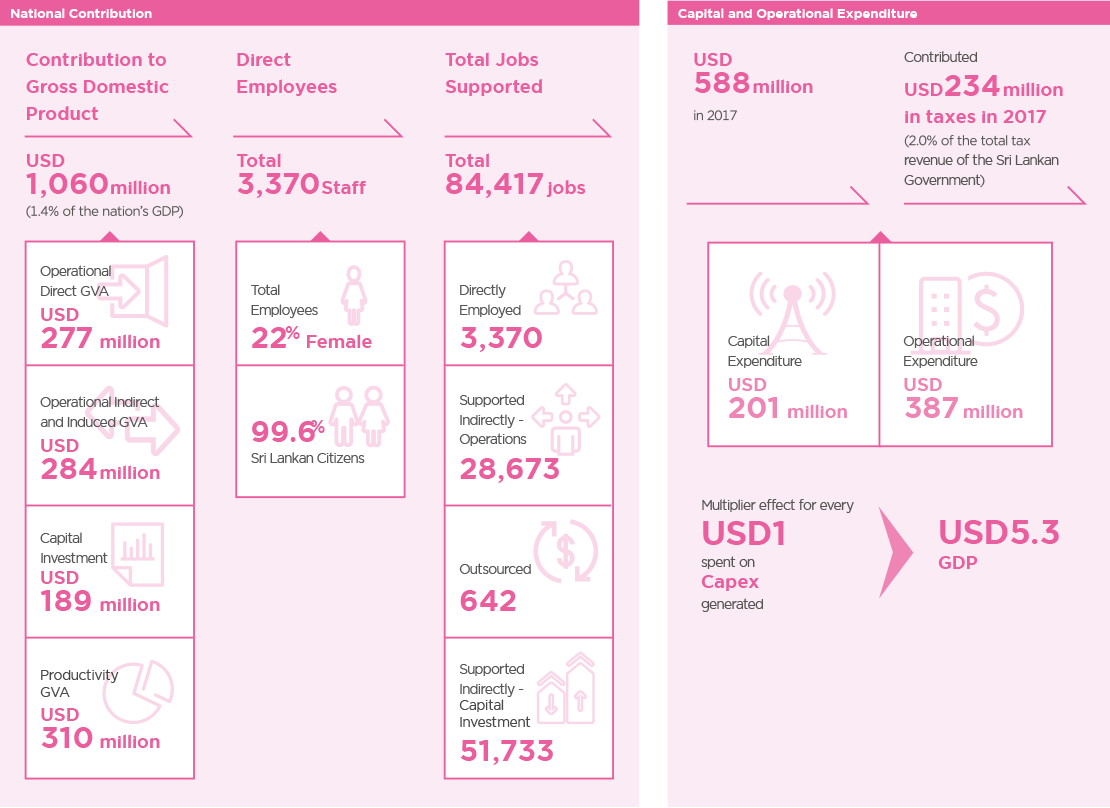

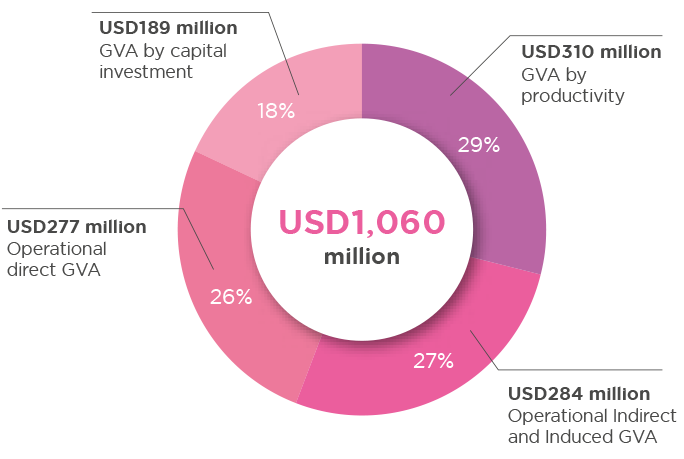

Figure 1: GDP contribution to the Sri Lankan economy 2017

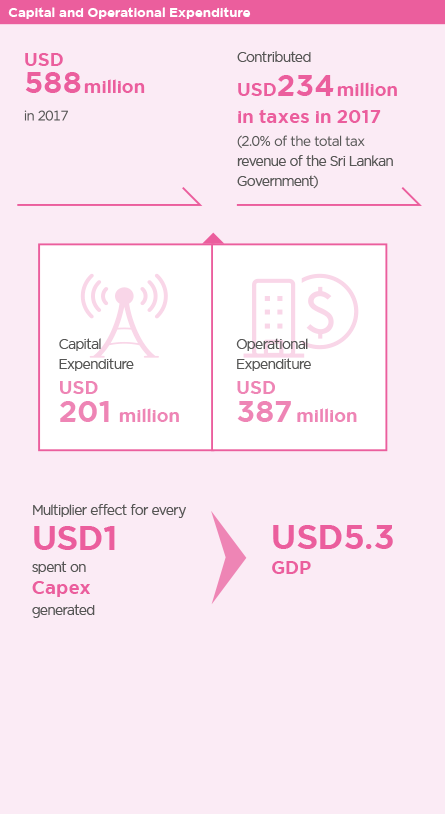

Economic and Financial Contributions

With a total operating expenditure of USD387 million and capital investment of USD201 million, Dialog’s total GDP contribution to the Sri Lankan economy was estimated at USD1,060 million. This comprised of contributions from Dialog’s direct operation of USD277 million, indirect contribution of USD284 million through procurement from local suppliers, USD189 million generated by Dialog’s capital investment and productivity gains of USD310 million through the increase in the mobile penetration rate of 4.8% in 2017 (see Figure 1). Every USD1 spent by Dialog through its capital investment contributed USD5.3 to the GDP.

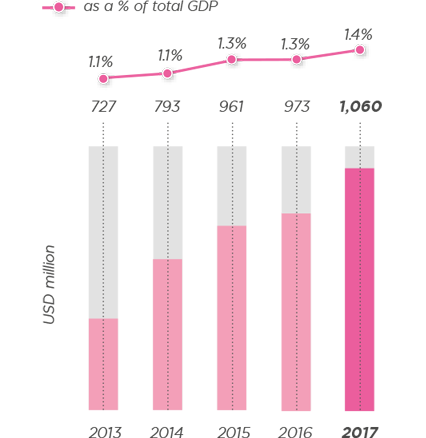

Dialog’s total GDP contribution grew at a CAGR of 9.9% from USD727 million to USD1,060 million over the last five years (see Figure 2). The improving trend was due to increased operational profits and a surge in the number of customers. The total number of mobile customers in Sri Lanka expanded to 28 million from 22 million during the same time period translating to a mobile penetration rate of 122% in 2016 (95% in 2012).

In 2017, Dialog Axiata lauched the Dialog Axiata Digital Innovation Fund (DADIF), a venture capital fund created to invest in Sri Lankan digital service companies and startups. DADIF has a fund size of USD15 million and is the largest corporate digital fund in Sri Lanka.

Figure 2: GDP contribution to the Sri Lankan economy, 2013-2017

Investing and Innovating for the Long-Term

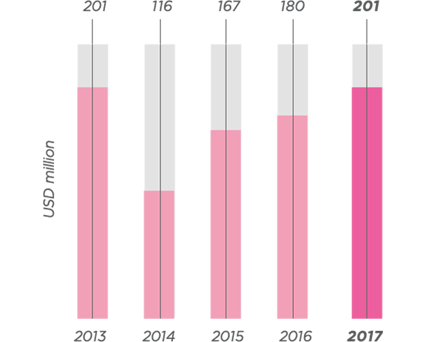

Dialog invested a total of USD866 million between 2013 and 2017. Dialog’s total investment of USD201 million in 2017 represented a 11.3% increase from USD180 million in 2016 (see Figure 3). Dialog is committed to further invest in Sri Lanka so as to enhance its network coverage and service quality in an increasingly competitive market.

Figure 3: Total capital investment: 2013-2017

Contributions to Public Finance

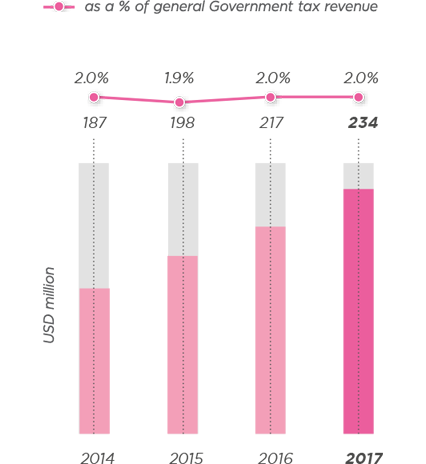

Total tax contributions for Dialog from 2014 to 2017 totalled USD837 million, expanding to USD234 million in 2017 from USD217 million in the previous year. Annual tax contributions increased by 25% in 2017 (see Figure 4). Dialog’s tax contributions in 2017 accounted for 2.0% of the Sri Lankan Government’s total tax revenue. Dialog’s tax commitments includes direct taxes such as corporate and withholding tax, as well as indirect taxes such as value-added tax and licensing fees.

Figure 4: Total tax contribution to public finance, 2014-2017

Note: 2014-2016 General Government tax revenue data is from Budget estimates 2015-2017, Ministry of Finance, Sri Lanka

Talent Development

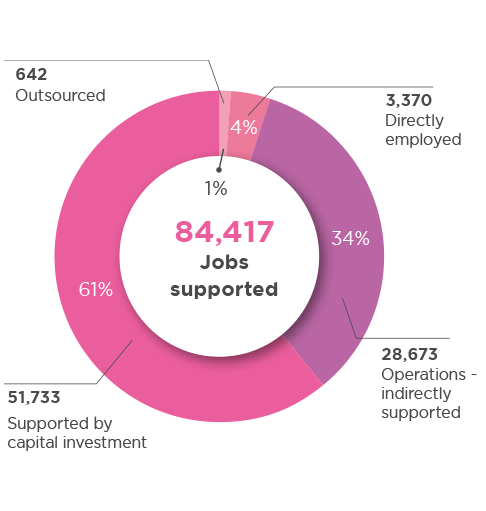

Dialog provided 3,370 direct jobs in 2017 of which 99.6% of the positions were staffed by Sri Lankan citizens (see Figure 5). About 22% of Dialog employees were women. During the year, Dialog engaged 11 new graduates, apprentices and interns as part of its goal to provide young people with specialist skills required in the digital economy. Dialog also indirectly supported an additional 28,673 jobs through its operations, and a further 51,733 jobs through its capital investments while a further 642 jobs were outsourced.

Figure 5: Total employment impact 2017

Dialog’s Labour Productivity

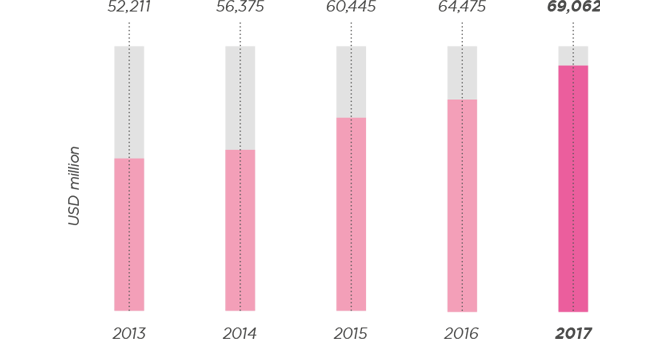

Dialog’s productivity, measured as Gross Value Added (GVA) per employee, grew by 32.3% from USD52,211 in 2013 to USD69,062 in 2017 (see figure 6). Annual growth rate of Dialog’s productivity was estimated around 7.2% over the last five years. Expanding operational profits contributed to the growth of productivity.

Figure 6: Dialog’s labour productivity, 2013-2017

In Support of the National Agenda

The Sri Lanka government recognises the potential disruptive technology and services have on the country’s productivity. The use of ICT plays an essential role in driving this national agenda of strengthening technology and digitalisation set out in the country’s Vision 2025 manifesto. Smart solutions and e-commerce are examples of how the government is facilitating the adoption of technology and digitalisation.

Smart Solutions

Sri Lanka’s ICT industry foresees the industry will generate USD5 billion in revenue, create 200,000 direct jobs and enable 1000 start-ups in its Vision 2022 report. The ICT Agency (ICTA) launched the SMART Society and Citizen Empowerment programme to build a digitally inclusive nation. Initiatives include establishing smart education (SMART Classrooms and Capacity Building program), health (integrated interoperable healthcare system), and public services (digital government and e-services).

Integrating ICT into urban development is the focus of the Western Region Megapolis Project Masterplan. To be completed by 2030, the new megapolis in Sri Lanka’s western province employs the smart city concept to boost economic growth, promote social harmony and improve environmental sustainability.

Dialog has unveiled South Asia’s first narrowband Internet of Things (IoT) enabled network to revolutionise ‘Dialog Smartlife’ services. With the introduction of ‘Dialog Smartlife’, Dialog has established a leadership position on innovative digital service supporting IoT solutions to connect customers.

Dialog Smartlife has launched two services. ‘Car Connect’ is an advanced Vehicle On-Board Diagnostics device and smartphone application. It provides vehicle performance and driving telemetric data to the driver. ‘Connected Home’ allows home owners to manage a vast array of functionalities within their homes by using a mobile application connected to security, temperature and humidity sensors.

E-commerce

Domestic B2C e-commerce in Sri Lanka is thriving, while B2B and cross-border e-commerce have yet to realise its full potential. The passage of the Electronic Transactions (Amendment) Act in 2017, provided a boost to Sri Lanka’s e-commerce agenda as it lifts a legislative roadblock and positions Sri Lanka in a more favourable position to carry out e-commerce trade over digital platforms around the world. An online e-commerce platform WEBXPAY was introduced and aimed to enable businesses, especially SMEs, to trade goods online with various multiple payment channels.

with Australia’s Department of Foreign Affairs and Trade (DFAT) to roll out a digital payment platform across 200 ATM locations in Sri Lanka’s Northern Province. Customers are able to withdraw money via eZ Cash, an e-wallet licensed by the Central Bank of Sri Lanka, across a wide network of corner stores and ATMs by using their mobile phones. They can also transact on-the-go and pay for goods, services and mobile reloads.

Bangladesh

Robi is the second largest mobile network operator in Bangladesh and was the first operator to introduce GPRS and 3.5G services, and to launch 4G service in all 64 districts.

Bangladesh has made notable progress in growth and development since 1990 and reached middle-income status in 2014. Underpinning this progress is the sustained robust economic growth averaging 6% over the past decade, almost doubling the world average in the June 2015 fiscal year.

The Bangladesh government launched the Digital Bangladesh by 2021 initiative, which has allowed for the digital market to grow rapidly over a short period of time. This project gave the Bangladeshi population opportunities to experience the benefits of mobile services. Digital Bangladesh is expected to expedite the transition to smartphone and internet connectivity.

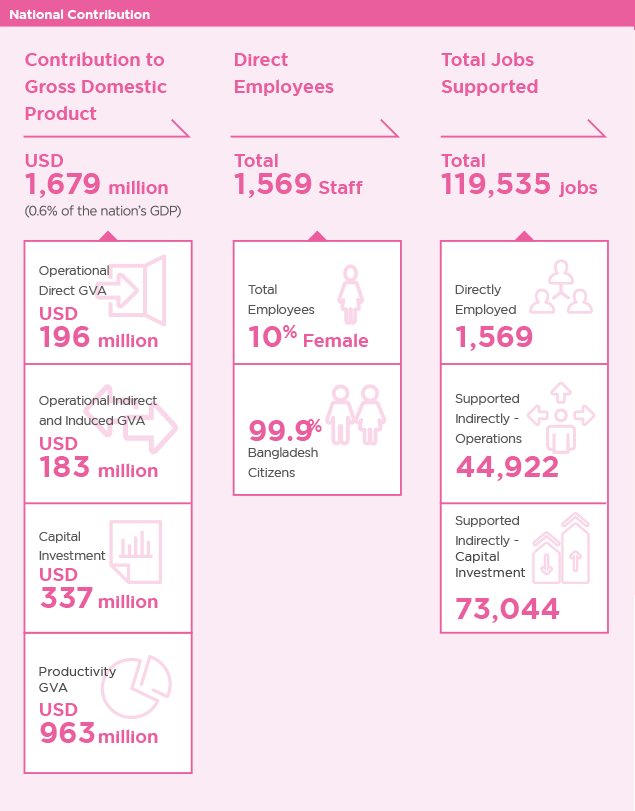

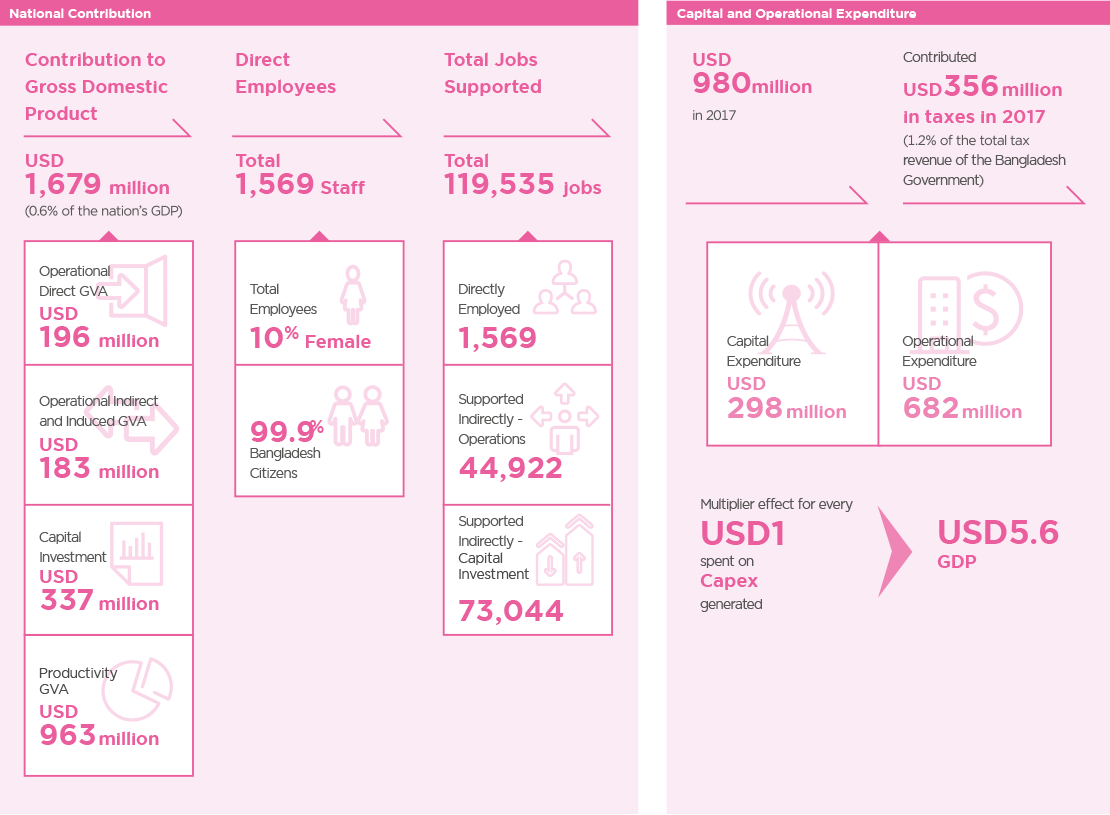

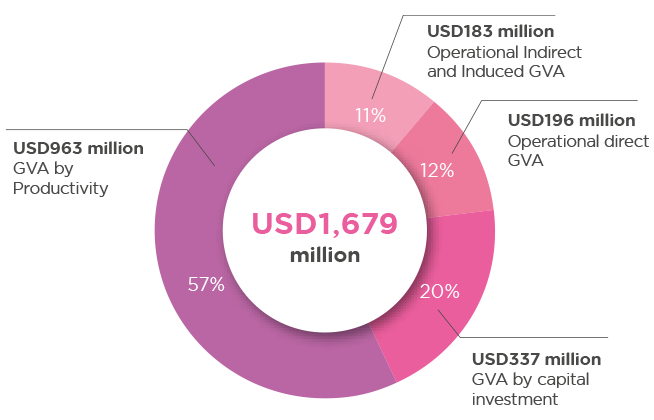

Figure 1: GDP contribution to the Bangladeshi economy 2017

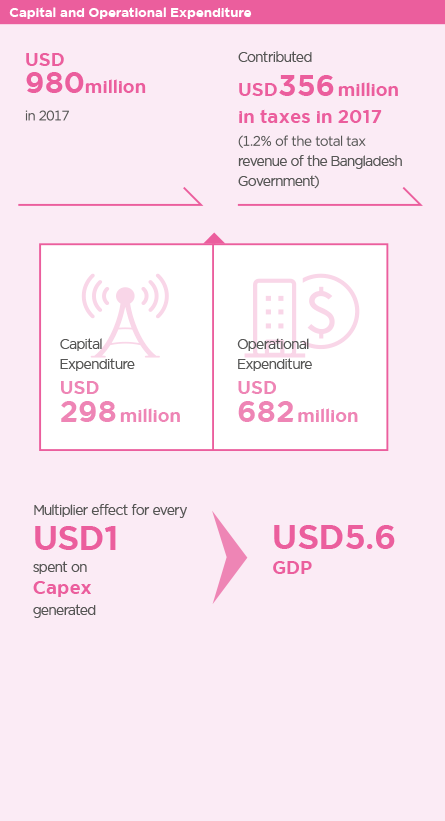

Economic and Financial Contributions

With a total operating expenditure of USD682 million and capital investment of USD298 million, Robi’s total GDP contribution to the Bangladeshi economy was estimated at USD1,679 million. This comprised of contributions from Robi’s direct operation of USD196 million, indirect contribution of USD183 million through procurement from local suppliers, USD337 million generated by Robi’s capital investment and productivity gains of USD963 million (see Figure 1). Every USD1 spent by Robi through its capital investment contributed USD5.6 to the GDP.

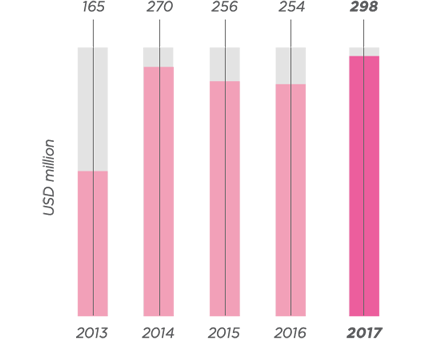

Figure 2: Total capital investment: 2013-2017

Robi’s total GDP contribution grew by 53.1% from USD1,097 million in 2013 to USD1,679 million in 2017, representing a slight decline in the share of the country’s GDP from 0.7% to 0.6% over 2013-2017. Total GVA dropped in 2016 to USD592 million. This drop was mainly due to the fluctuations of the mobile penetration rate in Bangladesh, which fell by 5.5% in 2016.

Investing and Innovating for the Long-Term

Robi invested a total of USD1,243 million between 2013 and 2017. The OpCo’s total investment of USD298 million in 2017 was significantly higher than the USD254 million invested in 2016 (see Figure 2). Robi’s capital investment increased by an average annual rate of 18.7% in 2017, as the company continued investing aggressively to ensure 4G readiness and fast-track its 3.5G network expansion with the aim to improve network quality and enable better customer experience both in voice and data services.

Contributions to Public Finance

Robi contributed USD356 million in taxes to the Bangladesh Government, accounting for 1.2% of the country’s total tax revenue. Robi’s tax commitments in Bangladesh include direct taxes such as corporate and withholding tax, as well as indirect taxes such as value-added tax and licensing fees.

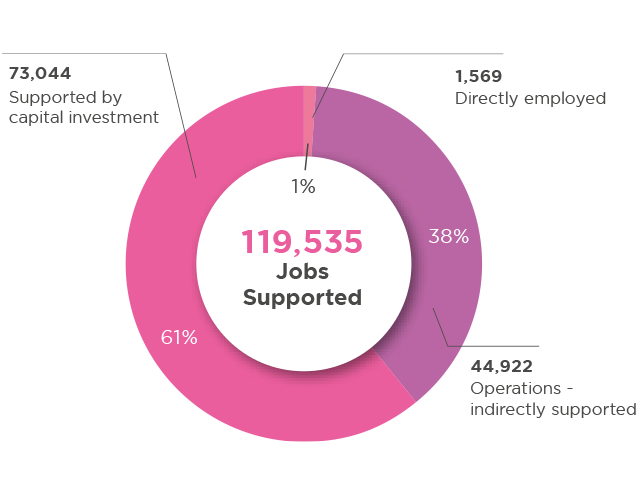

Talent Development

Robi provided 1,569 direct jobs in 2017 of which 99.9% of employees were Bangladeshi citizens (see Figure 3). About 10% of Robi’s employees were women. During the year, Robi engaged 61 new graduates, apprentices and interns as part of its goal to provide young people with specialist skills required in the digital economy. Robi’s operations also indirectly supported an additional 44,922 jobs. Its capital investments, meanwhile, supported 73,044 jobs.

Figure 3: Total employment impact 2017

Robi’s Labour Productivity

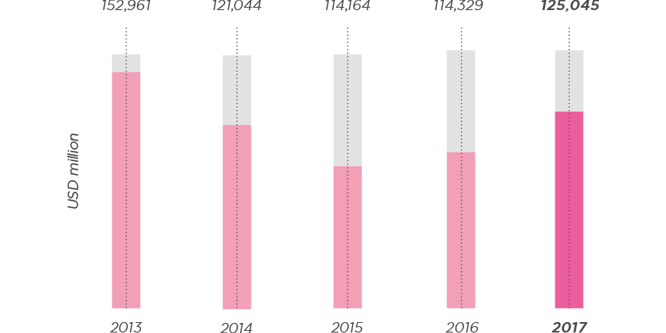

Robi’s productivity, measured as Gross Value Added (GVA) per employee, decreased by 18.3% from USD152,961 in 2013 to USD125,045 in 2017.

However, Robi’s productivity increased by 9.4% in 2017 due to the contracted employment. (Figure 4)

Figure 4: Robi’s labour productivity, 2013-2017

In Support of the National Agenda

Bangladesh’s 7th Five Year Plan (7FYP) highlights the significant contribution education and technology sectors have on the part of national development strategies. ICT investment improves education in the way of enhancing the capacity and quality of education with advanced infrastructure and technology. For e-commerce, ICT provides the technology foundation and changes consumers’ purchasing habits.

These strategies are aligned with the United Nations Sustainable Development Goals.

Education

Based on Bangladesh’s human resource development plan in the 7FYP, the government plans to achieve 100% enrolment rate, reduce drop-out rate, reduce gender discrimination, and improve the quality of education. To meet these ambitious targets, approximately 12.6% of the 2017-2018 national budget has been allocated for education. The government plans to invest in ICT-based interactive classrooms in 503 model primary schools to prepare student for the modern world of ICT.

As the second largest mobile network operator of the country, Robi has made significant contribution to education and knowledge sharing in Bangladesh. Robi’s 10 Minute School, is the country’s largest online school and offers free digital university admission classes through their website’s admissions portal. It recently opened an art studio equipped with facilities to create animated, interactive, 360 degree VR and live video content. This will enable the school to increase its efficiency to create content by 220%.

E-commerce

E-commerce is one the fastest-growing sectors in Bangladesh. In 2017, the market is estimated to be around USD110-115 million, with a growth rate of approximate 70%. The sector has larger growth potential with the penetration of internet and the policy of ‘No VAT’ on e-commerce. The e-Commerce Association of Bangladesh has recommended to keep the tax free policy until 2025.

As the country’s first telecommunications firm providing cloud solutions, Robi not only supports the national development of digital infrastructure but also promotes e-commerce by offering a new e-payment solution with the launch of “RobiCash App” in March 2017. Customers are now able to pay their utility bills, purchase Easyload and train tickets conveniently via the mobile application.

Re.Con is Robi’s digital advertising knowledge sharing platform. The digital platform is designed to promote and nurture discussions, talks, or idea sharing sessions related to digitalisation.

Cambodia

Smart Axiata Co., Ltd., Cambodia’s leading mobile telecommunications operator, serves eight million subscribers. Smart is at the forefront of mobile technology advancement in Cambodia and was the first network to introduce 4G LTE in 2014, 4G+ in 2016 and 4G+ with HD Voice (VoLTE) in early 2017. Its extensive nationwide network coverage stretches to more than 98% of Cambodia’s population.

After two decades of strong economic growth rate averaging at 7.4% (1994-2015), Cambodia attained a lower middle income status in 2015. Its strong growth rate ranks 6th in the world and is expected to remain strong over the next year through recovering tourism activity and fiscal expansion policies.

Mobile subscribers in Cambodia expanded from 21.1 million to 29.2 million in the past five years, increasing the mobile penetration rate from 140% in 2013 to 182% in 2017. The Cambodian government is making every effort in developing the internet and mobile infrastructure in the country to ensure that digitisation reaches all segments of Cambodian society.

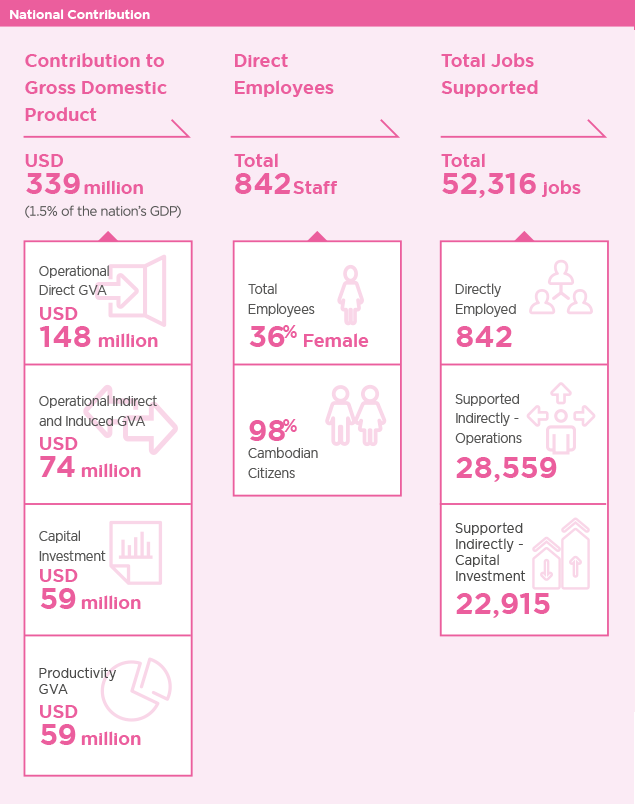

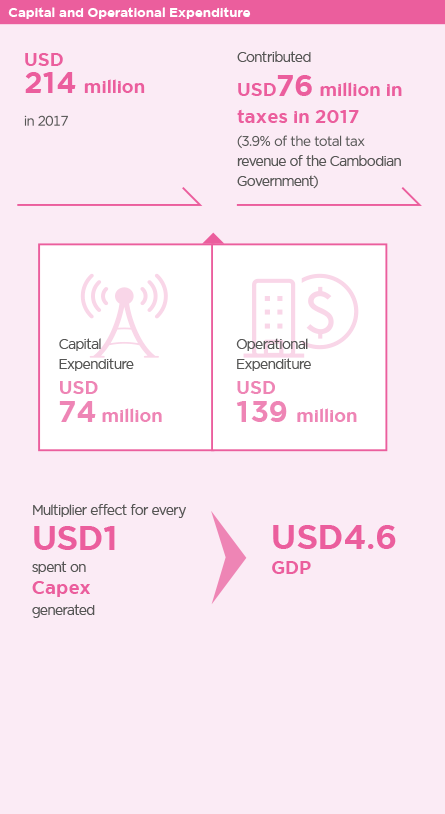

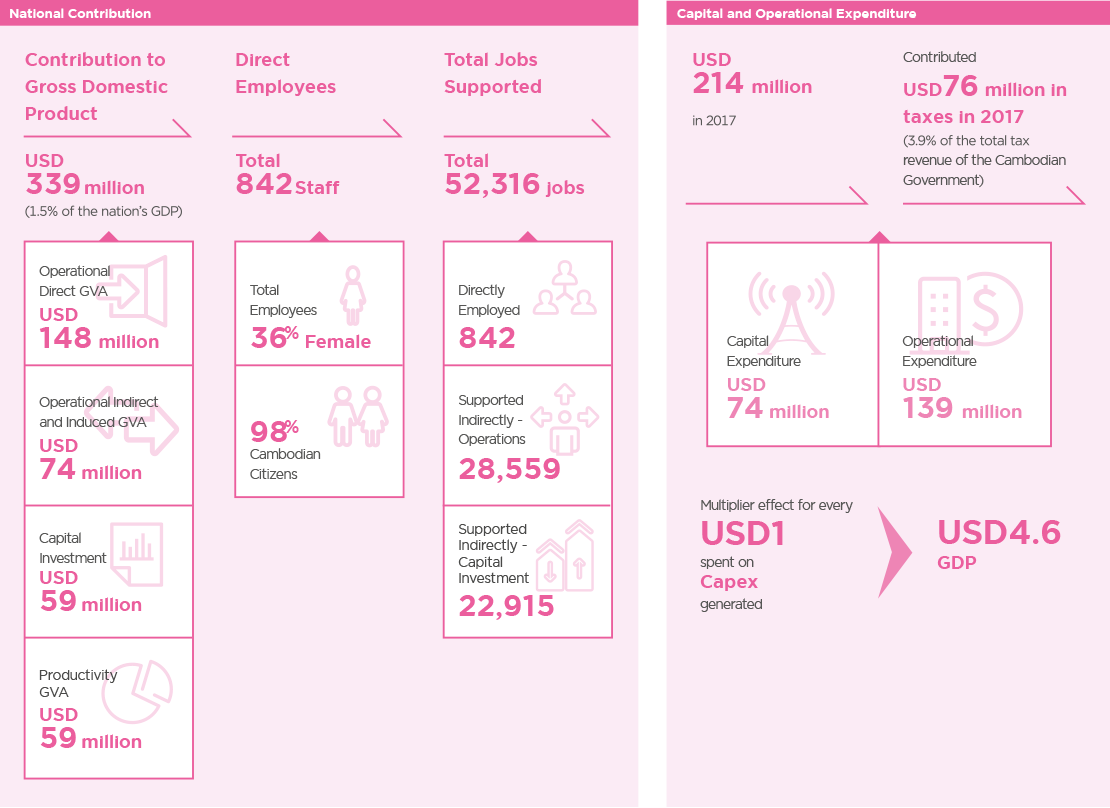

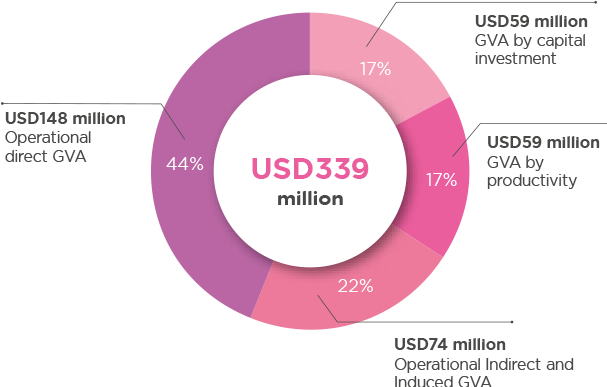

Figure 1: GDP contribution to the Cambodian economy 2017

Economic and Financial Contributions

With a total operating expenditure of USD139 million and capital investment of USD74 million, Smart’s total GDP contribution to the Cambodian economy was estimated at USD339 million. This comprised of contributions from Smart’s direct operation of USD148 million, indirect contribution of USD74 million through procurement from local suppliers, USD59 million generated by Smart’s capital investment and productivity gains of USD59 million through the increase in the mobile penetration rate of 9% in 2017 (see Figure 1). Every USD1 spent by Smart through its capital investment contributed USD4.6 to the GDP.

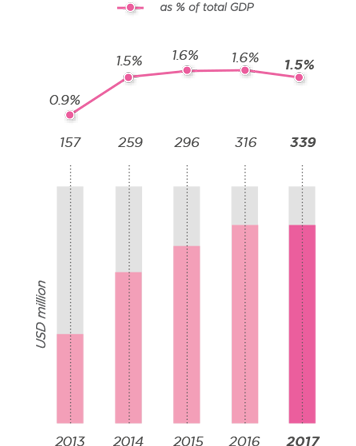

Smart’s total GDP contribution increased to USD339 million in 2017 from USD157 million in 2013, translating to a CAGR of 21.3% (see Figure 2). The improving trend was due to higher operational profits and significantly increased number of mobile customers. Over the last five years, total operational profits grew to USD137 million from USD62 million. With a total number of mobile customers (as active declared SIM cards by the operators) in Cambodia at 29.2 million as reported to the Telecommunications Regulator of Cambodia, the mobile penetration rate stands at 182% in 2017.

Figure 2: GDP contribution to the Cambodian economy, 2013-2017

Investing and Innovating for the Long-Term

Smart invested a total of USD313 million between 2013 and 2017 to improve its network infrastructure, including rolling out its 4G LTE network and expanding its range of products and services. The company’s total capital investment of USD74 million in 2017 represented a 7.1% increase compared to the USD69 million in 2016 (see figure 3). In its drive to deliver improved mobile services at an affordable price to all Cambodians, Smart launched 4G+ with HD Voice in early 2017. In August 2017, the company became the first operator to launch 4.5G in Cambodia, a testament of Smart being at the forefront of mobile technology advancement in Cambodia.

By the end of 2017, more than 88% of its 2,333 base stations across all 25 provinces were equipped with 4G while 100% of the base stations were with 3G. An independent study conducted by IDG ASEAN recognised Smart as Cambodia’s Best 4G LTE Provider in 2017. Smart plans to continue investing in the country to further enhance its 4G LTE leadership and enhance its offerings to stave off competitors in a saturating mobile market.

Throughout 2017, Smart was a key development partner of various ministries of the Royal Government of Cambodia, including contributing to the new Capacity Building and R&D Fund which focuses on developing the ICT sector in the country.

Figure 3: Total capital investment: 2013-2017

Contributions to Public Finance

Total contributions by Smart over the last five years reached USD255 million. This expanded to USD76 million in 2017 alone, up from USD24 million in 2013, representing a CAGR of 33.8% (see Figure 4). Smart’s contribution of USD76 million includes regulatory related fees, levies and payments. Smart’s tax contribution alone accounted for 3.9% of national tax income, excluding other regulatory related fees and payments.

Figure 4: Total contribution to public finance, 2013-2017

Talent Development

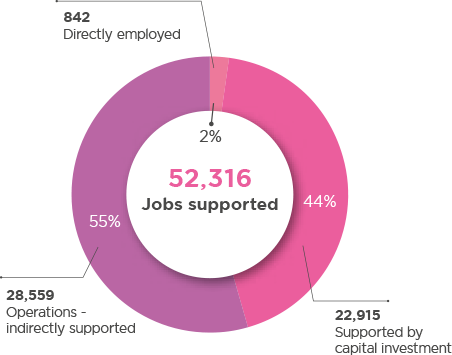

Total employment impact 2017

Smart provided 842 direct jobs in 2017 of which 98% of the positions were staffed by Cambodian citizens (see Figure 5). About 36% of Smart employees were women. During the year, Smart engaged 199 interns as part of its goal to provide young people with specialist skills required in the ICT and digital economy. Smart also indirectly supported an additional 28,559 jobs through its operations, and a further 22,915 jobs through its capital investments.

Figure 5: Total employment impact 2016

Smart’s Labour Productivity

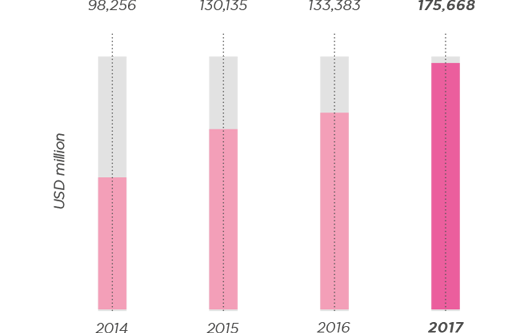

Smart’s productivity, measured as Gross Value Added (GVA) per employee, increased from USD98,256 in 2014 to USD175,668 in 2017 with a CAGR of 21.4% over 2014-2017 (see figure 6). Significant growth in operational profits and decline in employment support the increased productivity.

Figure 6: Smart’s labour productivity, 2014-2017

In Support of the National Agenda

ICT is essential to support the national development of smart solutions and technology. It creates new opportunities for SMEs and start-ups, and accelerates economic growth.

SME

As the primary source of job creation in urban and rural areas, SMEs play a vital role in the economy and socio-development of Cambodia. Facilitating the development of SMEs is a government’s priority as reflected in Cambodia’s National Strategic Development Plan 2014-2018.

Smart is driving innovation among the local tech startups. It supported and sponsored BarCamp, an international, innovative, and open technology two-day event in which individuals, businesses, students, young startups and professionals come together to share, learn, exchange ideas, and connect with one another.

In 2017, Smart Axiata’s Digital Innovation Fund (SADIF) was launched. The USD5 million fund is Cambodia’s first and largest venture capital fund for Cambodia-based digital service companies and startups. The Fund seeks to invest in innovative ideas and businesses in the digital ecosystem to spark the development of a robust digital economy. SADIF invested in three companies with a target to invest in 12 companies over the next five years.

Smart Solutions

Developing science and technology is one of Cambodia’s national priorities as reflected in the National Science and Technology Master Plan 2014-2020. The Master Plan models South Korea’s experience in developing a science and technology driven society. The ICT Federation of Cambodia has signed an agreement with its Korean counterpart to build a smart city in Preah Sihanouk province. Smart infrastructure such as intelligent traffic lights, parking, public safety, street lighting, waste management and environmental monitoring is within the scope of the project.

Smart Axiata is also committed to developing smart city solutions and support the development of the ICT industry in the country. In 2017, Smart Axiata was the first operator to launch 4.5G service in Cambodia, capable of providing up to 8x faster peak mobile internet speed than the normal 4G LTE.

ABA Bank, Cambodia’s leading private financial institution, has expanded its partnership with Smart Axiata to offer customers a link between ABA accounts and the SmartLuy e-wallet. By making fund transfer services easier and at a reasonable fee, the partnership will drive the faster adoption of the digital financial services.

Nepal

Ncell Private Limited has been connecting Nepal since 2004. Contributing to the vision of Digital Nepal and development of the country’s economy and infrastructure, Ncell’s best-in-class network brings communication services to people living in the most remote areas of Nepal. Ncell operates the widest 4G network in Nepal, fulfilling the national need of high-speed mobile broadband and creating new opportunities for the people of Nepal.

The Nepalese economy witnessed a broad-based rebound in 2017 as it recovered from the 2015 earthquakes. Inflation was moderate, government revenue and spending increased, and remittances grew. In FY2017, the Nepalese economy grew at 7.5% and public spending reached a record high of 8% of GDP.

Through the Department of Information Technology, the Nepalese government has implemented numerous projects aimed at addressing local developmental challenges through the digitisation of services. These projects were implemented and accelerated in efforts to rebuild after the devastating earthquakes in 2015.

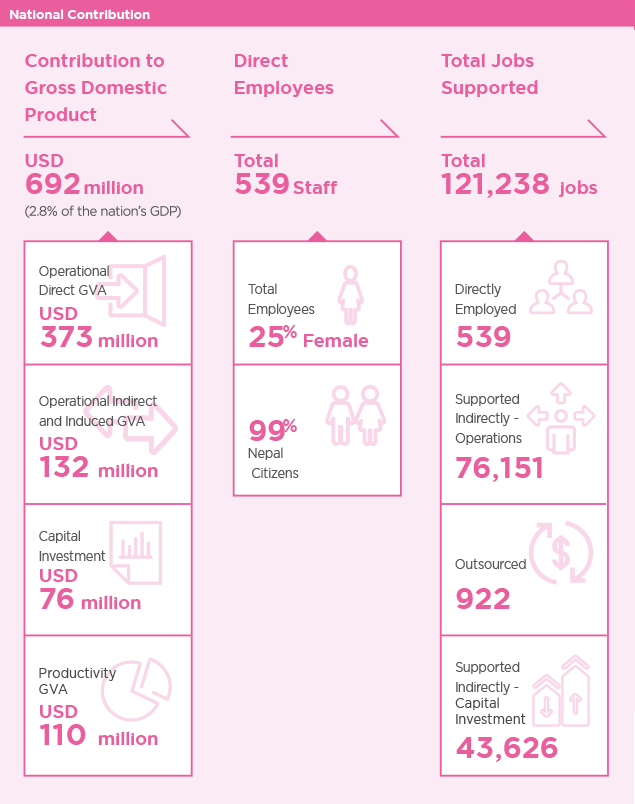

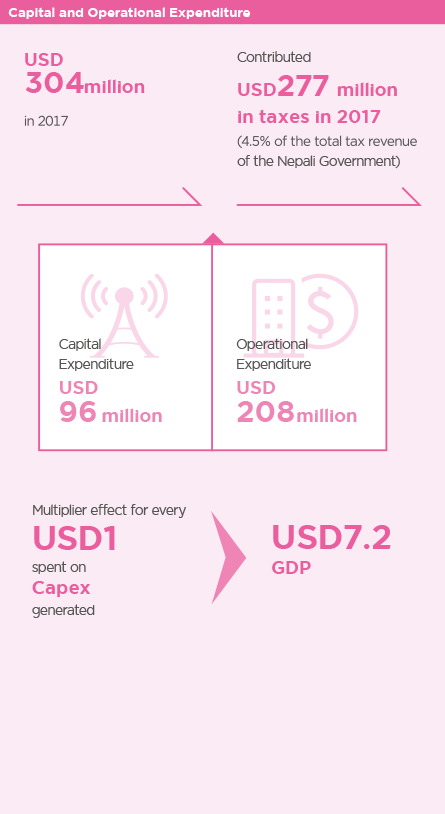

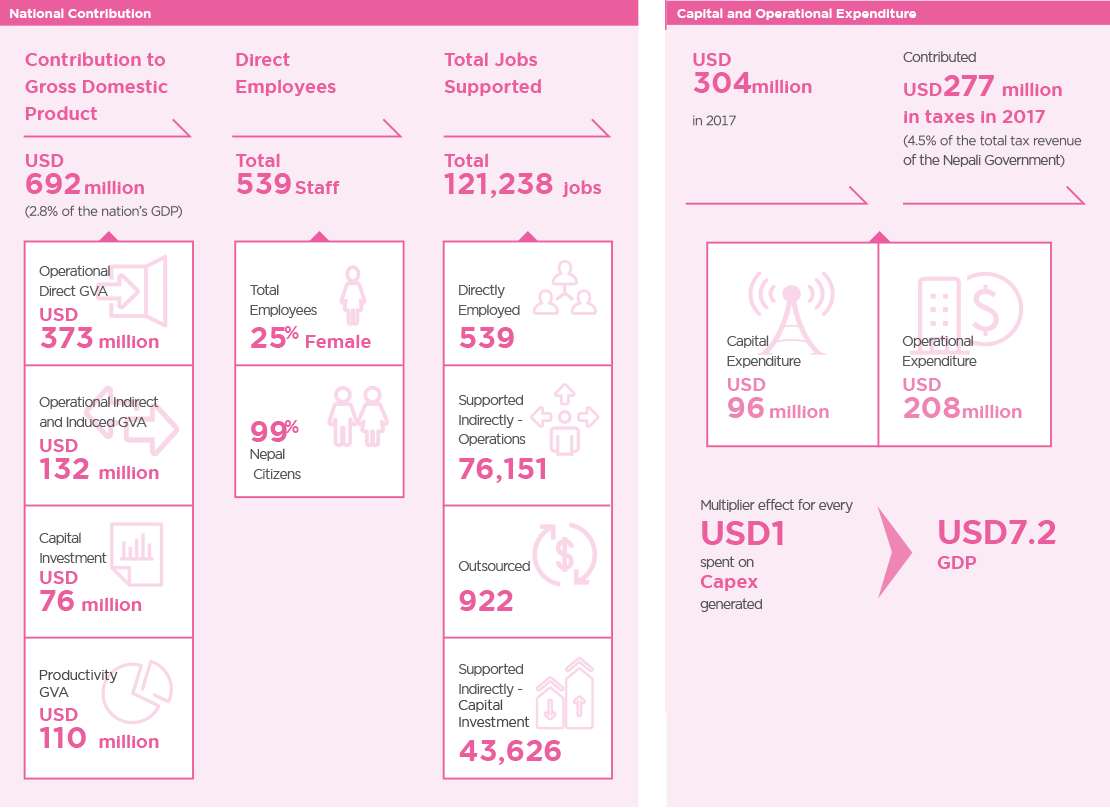

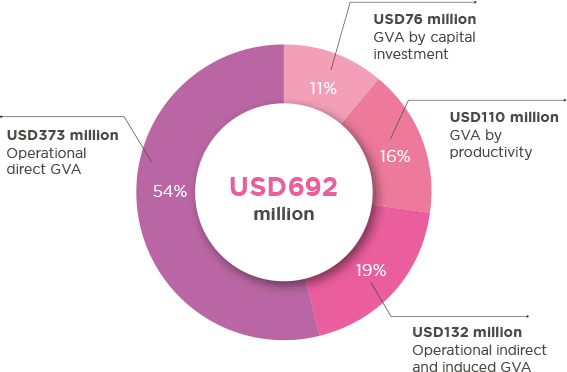

Figure 1: GDP contribution to Nepalese economy 2017

Economic and Financial Contributions

With a total operating expenditure of USD208 million and capital investment of USD96 million, Ncell’s total GDP contribution to the Nepalese economy was estimated at USD692 million. This comprised of contributions from Ncell’s direct operation of USD373 million, indirect contribution of USD132 million through procurement from local suppliers, USD76 million generated by Ncell’s capital investment and productivity gains of USD110 million through the increase in the mobile penetration rate of 6.3% in 2017 (see Figure 1). Every USD1 spent by Ncell through its capital investment contributed USD7.2 to the GDP.

Moving into 2018, Ncell will continue to focus on extending its data leadership as one of the key growth driver, whilst maintaining voice and international long distance revenue contribution. Ncell will also put greater emphasis on expanding its Digital Services ecosystem.

Investing and Innovating for the Long-Term

Ncell made capital investments totalling USD96 million in 2017 which grew by 57% from USD61 million in 2016. Capital investment plays a significant role in enhancing the company’s competitiveness and contributing to Nepal’s economy.

Contributions to Public Finance

Ncell contributed USD277 million in taxes to the Nepal Government, accounting for 4.5% of the country’s total tax revenue. Ncell was recognised by the Government of Nepal as the largest income taxpayer of the country in FY2012-2013 and 2013-2014.

Ncell contributes to the Government treasury in the form of License Fees, Telephone Service Tax, Ownership Tax, Value Added Tax, Withholding Tax, Income Tax, Royalty, Frequency Fee and Rural Telephone Development Fund.

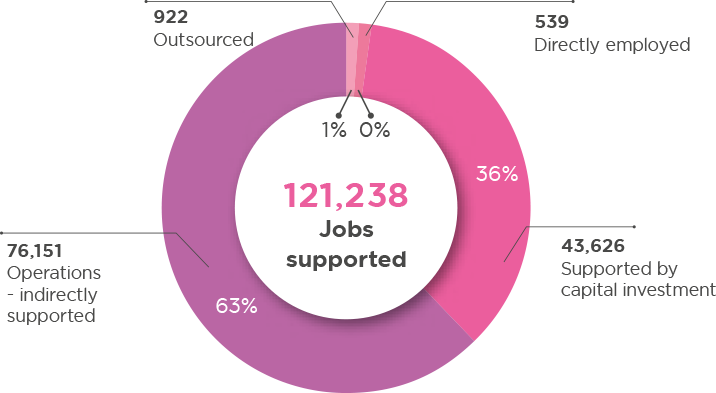

Talent Development

Ncell provided 539 direct jobs in 2017 of which 99% of the employees were Nepalese (see Figure 2). About 25% of Ncell employees were women. Ncell’s operations also indirectly supported an additional 76,151 jobs and outsourced a further 922. Its capital investments, meanwhile, supported 43,626 jobs.

Figure 2: Total employment impact 2017

Note: As a % of total GDP contribution; Numbers may not balance due to rounding

Ncell’s labour productivity

Ncell’s productivity, measured as Gross Value Added (GVA) per employee, was estimated at USD255,353 in 2017 (see figure 3). The high productivity was mainly due to its high operational profit, which accounted for more than 60% of operational revenue in 2017.

Figure 3: Ncell’s labour productivity, 2016-2017

In Support of the National Agenda

Human resource and agriculture are two key sectors under the ‘Envisioning Nepal 2030’ strategy set out by the Nepal National Planning Commission. ICT will play an important role driving these two areas to enhance national education, and provide disruptive solutions to transform and modernise agriculture practices.

Education

The vision of education for Nepal is to achieve universal basic education by 2025. Nepal aims to allocate 20% of the national total budget in 2018 towards education. The government is developing initiatives such as Education for All, and the School Sector Reform Plan to improve the quality of education and narrow the education gender gap. E-learning portals and universal access to ICT will support the government’s drive towards this vision.

Ncell has a long established record of supporting education development in Nepal. As part of the ‘Pahilo SIM’ campaign, Ncell provided partial scholarships to 48 Secondary Education Exam students to help them complete their bridge course before enrolling in college. The Ncell Scholarship and Excellence Award recognises top students pursuing a Bachelor of Engineering, Electrical, Electronics, Communications and Computer science with a bursary of RS.100,000.

Agriculture

Agriculture transformation is considered to be one of the key growth drivers of Nepal’s economy. Agriculture employs 78% of the economically active population in Nepal, and contributes 34% to the GDP. Two initiatives have been developed to improve income of the agriculture communities, The Knowledgebased Integrated Sustainable Agriculture and Nutrition Project (KISAN); and the Agriculture and Food Security Project (AFSP) will improve productivity, strengthen competitiveness, build resilience, and a stronger enabling agriculture environment.

As part of its Corporate Social Responsibility initiative, Ncell has supported rural communities in ensuring sustainable development and access to basic needs. Ncell supported households in the hilltop villages of Syangja district by providing access to water through installing water pumps. Equipped with smart metering, the pumps have helped communities improve their livelihoods as they can efficiently manage water for household and commercial farming. Families are able to earn extra income by growing high-value crops using drip irrigation.

Methodology

1. Methodology

1.1 Methodologies and computational formula

Direct Value Added contributions were estimated based on operational data provided by Axiata regarding operating revenues, operating expenditures, compensation of employees and indirect taxes and levies.

Total Value Added contributions were estimated using an economic multiplier. The total multipliers (Type II) for the Telecom industry were derived from national Input-Output (I-O) tables published by OECD, ADB and national statistical agencies.

Employment is generated through a number of avenues including:

- Directly through Axiata and related industries.

- Outsourced support services including customer support and network operations and maintenance.

- Indirectly through firms that provide services to Axiata’s operations.

- Induced as employees from the above spend their household income thereby generating further rounds of employment.

Total employment impact is estimated using I-O tables and Average Value Added per Worker derived from relevant Departments of Statistics for each country.

1.2 Capital Investment

-

Total Value Added = Capital Expenditure x Proportion Spent in Host Country x Average Value Added Multiplier

-

-

For countries employment multipliers are available,

Total Employment in Host Country = Total Capital Expenditure in Host Country x Average Employment Multiplier -

For countries employment multipliers are not available,

Total Employment in Host Country = Total Capital Expenditure Value Added in Host Country/Average Value Added per Worker in Host Country

-

1.3 Operational

-

Total Value Added = Direct Value Added x Total Value Added Multiplier

Where,

Direct Value Added = Operating Revenue – Operating Expenditure + Compensation of employees + Indirect taxes and levies

Note: Operating expenditure provided by Axiata excludes depreciation.

-

-

For countries employment multipliers are available,

Total Employment = Total Operational Expenditure x Average Employment Multiplier -

For countries employment multipliers are not available, Total Employment = Total Indirect Value added/Average Value Added per worker + Direct Employment Direct Employment = As per Axiata data 3. Axiata’s labour productivity

-

-

Axiata’s labour productivity = Direct Value Added/ Number of employees

Note: Number of employees includes both direct and outsourced employees.

1.4 Productivity Analysis

Axiata Contribution to GDP Growth = National Contribution to GDP Growth x Market Share of Axiata

Where,

National Contribution to GDP Growth = National Penetration Growth x Growth Factor Penetration = Number of Customers/Population

Note: Growth Factor was assumed to be 1.2% per 10% change in market penetration for all countries except 0.6% market penetration for Singapore

1.5 Multiplier Analysis

Capex Multiplier = Total Axiata’s Value Added Contribution/Capital Expenditure

Note: Total Axiata’s Value Added contribution includes Operational Direct Value Added, Operational Indirect and Induced Value Added, Value Added by capital investment and Productivity impact.